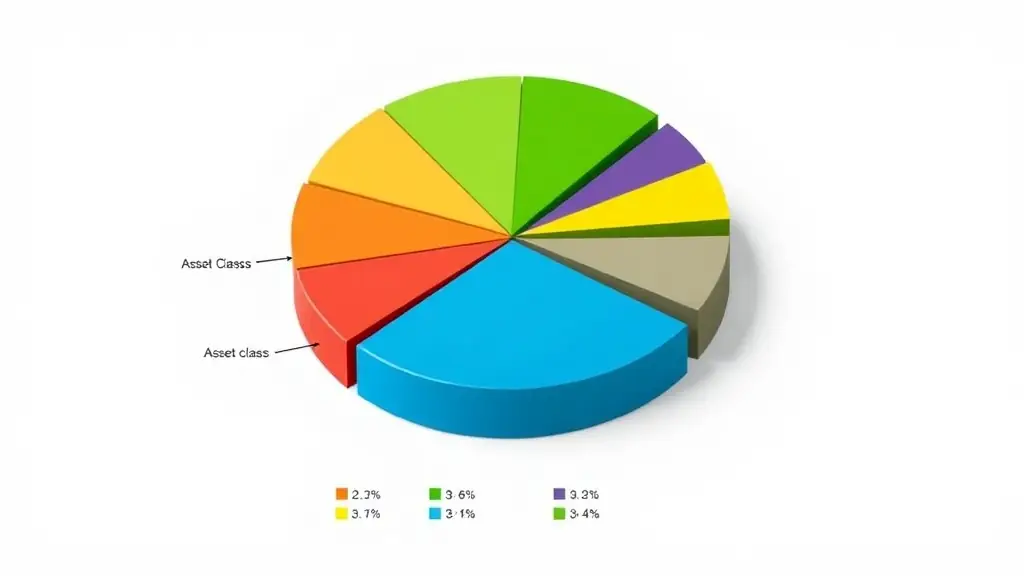

Diversification is a fundamental principle in investment strategy, and venture capital is no exception. By spreading investments across various sectors and stages, venture capital firms can mitigate risks associated with individual investments. This approach not only protects the portfolio from market volatility but also increases the chances of capitalizing on high-growth opportunities. A well-diversified portfolio can provide a more stable return over time, which is essential for attracting and retaining investors.

Moreover, diversification allows venture capital firms to tap into different market trends and innovations. By investing in a range of industries, firms can position themselves at the forefront of emerging technologies and consumer behaviors. This proactive approach enables investors to identify potential winners early on and capitalize on their growth. Additionally, it fosters a culture of innovation within the firm, as teams are encouraged to explore new ideas and sectors.

Finally, diversification can enhance the overall reputation of a venture capital firm. A portfolio that includes successful investments across various sectors demonstrates the firm’s expertise and adaptability. This reputation can attract more high-quality deal flow and partnerships, further strengthening the firm’s position in the competitive venture capital landscape.